Thinking of changing professional advisers? The information below will show you how easy it is to change (step by step) and at the same time show you a bit about how we work and we hope you will see how we are different to our competitors and this inspires you to work with us.

Let us help you realise your ambitions

Things to look out for when you decide to change accountants:

Step 1

Find a new accountant, you should take your time to ensure the new accountant will meet all your needs and expectations and has experience in the type of business you are running. Once you are happy you have found a suitable accountant you should appoint them to act for you. At the same time you should inform your existing accountant that you are leaving them and that they have your permission to pass over all details/documents to the new accountant when requested. This can be done in writing or via email.

Step 2

Your new accountant will write to the old accountant as a professional courtesy requesting all documents that are held on behalf of yourself, as the client, and clearance to act. At the same time you should provide all information you hold to the new accountant that they request.

Step 3

This is the step that takes the longest because it relies on the old accountant providing all takeover documents (copies of accounts, CT600’s, trial balance, VAT returns etc.) in a timely manner. Provided the old accountant co-operates then the delays should be minimal and your new accountant will be able to start bringing your file up to date.

Step 4

With the file up to date you will now be in a position to make use of your new accountant when necessary and your new accountant will be in a position to process your paperwork.

Things to watch out for when transferring accountants:

-

You may wish to avoid transferring part way through the company’s financial year as this may give rise to additional ‘takeover’ or ‘catch-up’ fees, meaning you are, in effect, paying twice for your accounting needs

-

There will be delays in receiving a full service from the new accountant if the old accountant is not forthcoming in providing all the takeover information as requested

-

Check carefully with your old accountant regarding transfer or termination fees. We do not charge any termination fees if you decide to cease using our services.

Appointing D C Accounting Services as your new advisers:

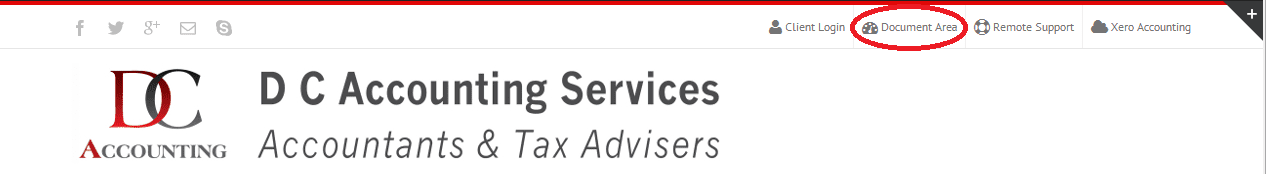

Become a client and enter the Document Area’. The Document Area is an area of our website where we provide clients’ their own secure portal where they can communicate with us at any-time of the day or night! Once you become a client you will have access to this link in our menu:

When you enter the Document Area you can see all of your files/documents. These maybe files/documents that you have sent to us via our upload facility or they may be documents we have provided for you – such as your draft accounts or any queries we may have with your affairs.

There is an initial set-up process and inevitably this does include some ‘paperwork’ that needs to be completed.

However, we make this process extremely simple and should you choose, you don’t even need to put pen to paper. All you need to do is register on our site and send a quick e-mail to say you would like to be a client and work with us. We will then convert your account to a client account. This will then give you ‘HUB’ access to our website.

Step 1

Allow us to communicate with your existing advisers

This is a letter from you to your existing accountants and tax advisers given your consent for them to speak to us and provide us with the information we need to take over your affairs.

We will provide you with this letter via the HUB. You may then sign this online and we will be notified you have done so. You may also download a copy if you wish.

Once we have received notification we will write a letter (professional courtesy) to your existing accountants and tax advisers.

We ask them if there is any reason why we cannot take you on as a client. We have to ask this as part of our professional guidelines but it doesn’t normally present any problems.

We also ask them for any relevant information obtaining to your affairs, like, should we be aware of any allowable losses to be offset in the period for which we take over?

Step 2

Allow us to correspond with H M Revenue & Customs

This is a form that enables H M Revenue & Customs to discuss your tax affairs with us.

We will provide you with this form via the HUB. You may then sign this online and we will be notified you have done so. You may also download a copy if you wish.

Once we have received notification we then send the completed form to HMRC.

Step 3

Personal letter

This is a personal authority letter given by you. This letter is a back up to the above form 64-8. H M Revenue & Customs have a habit of saying they do not poses the correct form (64-8) and therefore cannot speak to us about your tax affairs. Should this happen we can then immediately send them a copy of this letter whilst we send them another authority form.

Whilst we are converting your account to a client account and setting up the above documents please take the time to provide us with as much information as possible. Once you have registered on our website you just need to click here to update your details:

This would be a great help to us and makes the process even easier; and we all like things easy!

We are delighted that you have chosen to work with us and we look forward to a long working relationship and we cannot wait to see you realise your ambitions.